New Ideas WANTED! Taiwan Advisory Business

- Nelson Huang

- Nov 19, 2019

- 3 min read

Updated: Sep 8, 2021

NIC insight last month was about the slowing down in issuance of bond ETF in Taiwan. However, the slowing down in bond ETF market has made our clients become more focus on issuing new active managed funds. Our recent visits to SITEs have received some positive feed-backs, new funds are on the way. NIC Insight will take you to the advisory market in Taiwan, including details in AUM allocation, capabilities needed, and the foreseeable trend.

Onshore Fund Market Overview

Total Onshore funds manage over USD 122bn at the end of September 2019, 68% are invested in overseas markets. Investors in Taiwan are willing to put their money in overseas markets, seeking for higher returns and risk diversification. With 6% of the assets invested through fund of funds in overseas targets, 94% are invested directly. However, the funds that are actively managed account for 45%, USD 34,882mn, of the actively managed funds.

There are a lot of actively managed funds that are advised by offshore asset companies. For some SITEs with strong asset managers as their parent company from other countries, they often choose to use advisory services provided within the group. However, most of the SITEs in Taiwan are still local companies with less exposure to overseas investments and limit access to investment talents that focus on other markets. NIC, with most of our colleagues previously working in buy-side, is now assisting local SITEs in developing new products and matching their needs with suitable foreign asset managers. We have now observed rising interests in funds with (1) remarkable performance, (2) unique characteristics, or (3) strong downside protection. We have been introducing some of our partners' fine products and will be continually searching for suitable products for our clients in Taiwan.

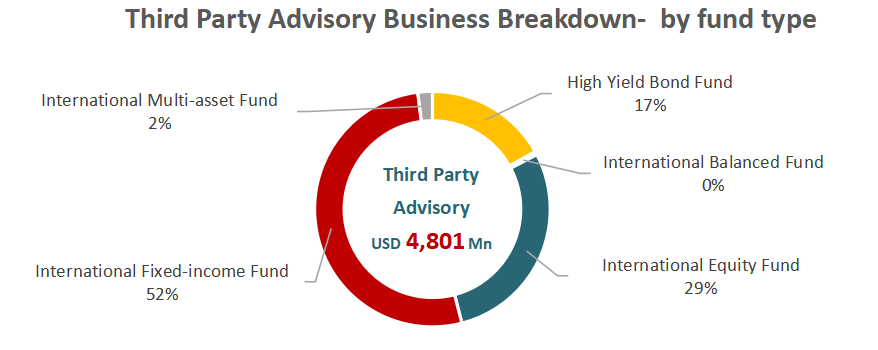

NIC has conducted a thorough research and found out that the market size of the funds that are advised by third party. The total AUM utilizing resources from outside of the group is about USD 4,801mn at the end of Sept. 2019. We are certain that the number will increase significantly, the reasons will be mention in the following chapter.

What kind of capabilities are needed?

In terms of product diversification, we are expecting more interesting strategies joining this market. Current advisory service focus on fixed-income funds (52%), however over 90% of the advised fixed-income funds are target maturity bond funds. SITEs were seeking for target maturity fund advisory service was due to the instant demand for the product and lack of time to build up an in-house team. Besides, famous advisory providers could be helpful in marketing as well. We expect the similarity of target maturity funds would make it easier for new strategies to stand out. Take a closer look at the Target Maturity Bond Fund market, there are some new funds with special features recently, such as ESG、Islamic、Ladder or Trigger maturity bond fund. Product developers are still looking for more. We have received great feedbacks that the demand lies not only in fixed income strategies, but also in multi-asset and equity strategies with special investment ideas.

Rising Demand for Advisory Service

We are expecting SITEs’ requirements for advisory services to rise due to the following two reasons:

(1)Constraints on Bond ETFs and Target Maturity Bond Fund

Due to the surge for Bond ETFs and Target Maturity Bond Funds, some of the SITEs in Taiwan were experiencing a rapid increase in AUM in the past 2 years. However, FSC had a conversation with these local asset managers and make their point quite clearly: The rapid increase should be moderated. It is necessary for SITEs to develop other products that can attract markets and investors’ attention. NIC has received a lot of feed-backs from our clients looking for new investment ideas, and we would love to share with our partners so feel free to call us for further discussion.

(2)Changes in fee calculation model

The fee calculation model will be changed from the current commission-based model to the percentage-of-AUM fee model, said FSC, the regulator in Taiwan. In that case, the quality and long-term performance of the funds are more important for distributors than ever and the AUM would be more stable. And of course, the number of new IPO’s might be moderately decreased due to the strict selection of the product. Distributors will be more cautious about selecting funds, and so are SITEs. This would be a great timing to introduce outstanding investment capabilities to the market.

NIC has been serving as a bridge to connect our partners with clients. Please don’t hesitate to Contact Us if you are willing to share your capabilities with us.

Comments